Pakistan is home to vast mineral reserves, including lithium, copper, and rare earth elements (REEs), which are crucial for industries such as electric vehicles, semiconductors, aerospace, and defense. However, due to inadequate infrastructure and financing, these valuable resources remain largely underexploited.

With a renewed focus on infrastructure and mining sector development, Pakistan is now opening its doors to Foreign Direct Investment (FDI). This presents a strategic opportunity for the United States to secure critical minerals before global competitors such as China and Russia expand their presence in the region.

A Rich Yet Underdeveloped Mining Sector

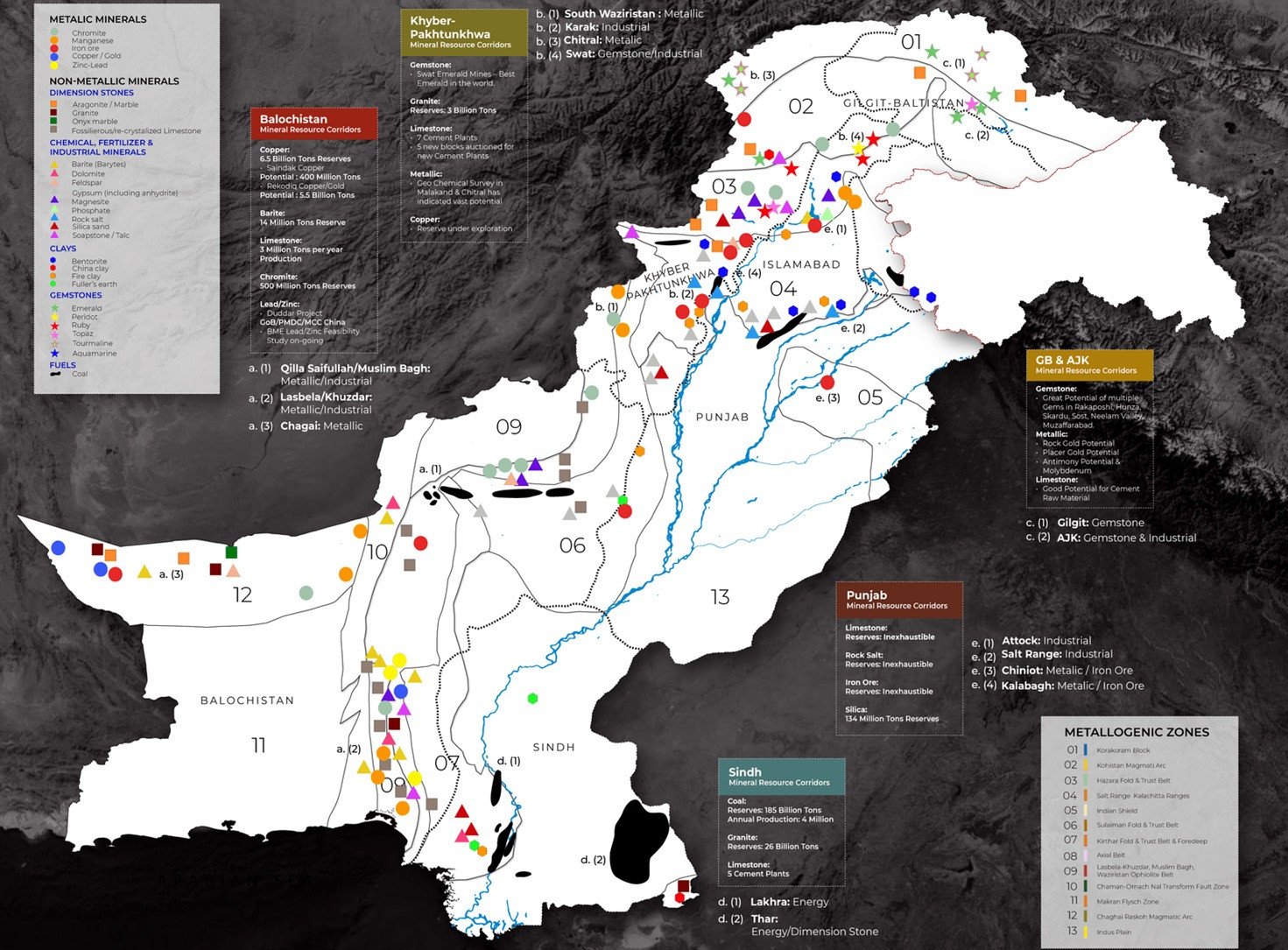

Pakistan’s mineral wealth includes lithium—essential for electric vehicle batteries and renewable energy storage—rare earth elements crucial for advanced electronics and defense, copper for electrical wiring and infrastructure, and gold, a key economic asset. Despite these abundant resources, the country’s mining sector remains in its infancy, making it one of the last few untapped markets for major investments.

Dr. Sultan Ahmed Khoso, an expert in mineral processing engineering and assistant professor at Mehran University of Engineering and Technology (MUET), highlights that while large-scale coal, gold, and copper mining is taking place in Sindh and Balochistan, other valuable minerals, such as chromite, iron, zirconium, lead, zinc, cobalt, titanium, manganese, and REEs, remain largely unexplored.

“Pakistan is a hub for mineral investments, but developing these resources requires expertise, advanced technology, and infrastructure,” he emphasized.

Government Incentives for Investment

To attract foreign investors, the Pakistani government has implemented several reforms, including tax breaks for mining companies, relaxed mineral exploration laws, and bilateral treaties to facilitate international investments.

Additionally, Pakistan’s deep-sea port at Gwadar offers lucrative export opportunities. With the China-Pakistan Economic Corridor (CPEC) providing a robust logistical network, expanding mining operations can further enhance global mineral trade routes.

A Strategic Opportunity for the US

For the US, investing in Pakistan’s mineral sector is not just an economic opportunity but a strategic move. With increasing global demand for minerals, reliance on China has become a growing concern. By securing mineral resources from Pakistan, the US can diversify its supply chain and reduce dependence on China while gaining greater control over critical raw materials.

According to BCG, a consultancy firm, about 20% of the minerals required by 2035 have yet to be discovered. With rising demand for metals in electrification, artificial intelligence, and power grids, global players are investing billions in exploration.

In the past, US resource planning has largely overlooked Pakistan. However, with ongoing talks with Ukraine and high extraction costs in Australia and Canada, Pakistan’s untapped reserves and cost-effective mining industry present a viable alternative.

Racing Against Global Competitors

As the world shifts towards clean energy, technological advancements, and military modernization, the demand for rare earth minerals is skyrocketing. The US must act swiftly to solidify Pakistan as a strategic mineral partner before global competitors, particularly China and Russia, establish dominance in the region.

With its rich deposits, favorable investment climate, and strategic location, Pakistan has the potential to emerge as a key player in the global mineral market—offering the US a unique opportunity to secure critical resources for its industries and national security.